HISTORY OF BANKING IN INDIA

The banking system is the base for the economic development of a country.

In this article, we are going to read about "History of Banking in India". It dates back to before India got independence in 1947. In India, changes in the banking system and management has been made with the advancement in technology and considering the needs of people.

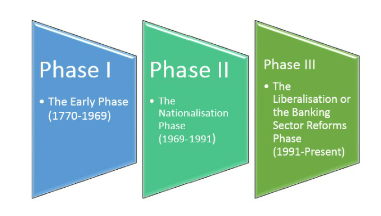

The Developments in the banking sector can be classified into three phases:

The Bank of Hindostan (1770-1832) was established by the agency house of Alexander and Company. It is considered one of the first modern banks in colonial India. It was located in the then, Indian capital, Calcutta. Furthermore, it is now a defunct bank, but it was particularly successful and ceased its operation in 1832. The Bank of Hindostan finally went under liquidation when its parent firm M/s Alexander and Co. failed in the commercial crisis of 1832.

The General Bank of Bengal and Bihar (1773-75) was the state-sponsored institution set up in participation with local expertise. Though the bank was running successful and earning profits. It was short-lived and it got officially liquidated. This bank was among the first issuers of currency notes, and its notes enjoyed government patronage.

The Paper Currency Act 1861, was enacted by the British Government. The Act gave monopoly rights to the Government of India to issue paper currency in the country. The act gave an end to Private and Presidency Banks to issue notes. Initially, Presidency Banks were given the right to manage the notes issued by the Government and these notes were printed by the Bank of England until the establishment of India's first currency printing press in Nashik in 1928. In 1935, RBI was established and the responsibility of issuing currency notes was handed over to RBI under Reserve Bank of India Act, 1934.

Presidency Banks:

In India, Presidency Banks were established under charters from the Government of British East India Company. The Government Charters granted the privilege of issuing banknotes for circulation within their circulation. The wide use of banknotes in the country came with the note issued by the semi-government Presidency Banks. The Bank of Bengal had a major part in issuing and circulating banknotes.

Bank Of Bengal:

The Bank of Calcutta was founded on 2 June 1806 as a Regional Bank. It was the first semi-governmental Presidency Bank. Originally, the bank was formed to provide financial assistance to British East India Company. In the early 18th century, The Government of British East India Company was in financial crises due to wars against Tipu Sultan and Marathas. The Bank was formed to fund such wars. The Founders of the bank were British East India Company, some European Merchants and a few wealthy Indians.

Later in 1809, the bank was granted a Charter by the British Government to serve the whole of Bengal. The Bank was renamed as Bank of Bengal on 2 January 1809. The Bank was established with a share capital of Rs.50 lakhs making it the first Joint Stock Bank of India. The charter provided the privilege of limited liability for shareholders.

The Government held a minority shareholding in the Bank of Bengal but the Government Officials were dominant over the bank. In the beginning, the Board of the bank was constituted by having one Indian Director- Maharaja Sookhmoy Roy and all other Directors and Employees of the bank were British. Though the Bank was incorporated in India it served in Bengal as a foreign bank and catered its services mostly to white customers.

The Bank of Bengal played a major role in issuing and circulating paper currency. The paper notes issued by the bank can be broadly categorised into 3 Series:

Bank of Bombay

|

| Image Source: https://www.rbi.org.in/ scripts/pm_papermoney.aspx |

The Bank of Bombay was the second Presidency Bank in the British East India Company Rule. The Bank was established on 15 April 1840 having its headquarters in Bombay, now called Mumbai. The Bank of Bombay had a chequered history. In 1868, the bank was liquidated due to the crisis of the speculative cotton boom. However, the bank was reconstituted in the same year.

The Bank of Bombay developed itself as a major commercial centre. It performed all the activities of a commercial bank and conducted certain functions which are generally preserved for central banks. Like other Presidency Banks, The Bank of Bombay also issued currency notes which were legally tendered. The Banknotes bore vignettes of statues of Sir Mountstraut Elphinstone and Sir John Malcolm.

Bank of Madras

|

| Image Source: https://www.rbi.org.in/ scripts/pm_papermoney.aspx |

The Bank of Madras was the third Presidency Bank. In 1843, it was established as a Joint Stock Company by amalgamating some existing banks in the region. Carnatic Bank (1788), the British Bank of Madras (1795), and the Asiatic Bank (1804) are the banks which were amalgamated to form Madras Bank. The Bank of Madras also performed all the activities of a commercial bank and conducted certain functions which are generally preserved for central banks. The Bank issued paper notes in the Madras Presidency and it had the smallest issue as compared to other Presidency Banks. The notes bore the vignette of Sir Thomas Munroe, Governor of Madras (1817-1827).

Reserve Bank of India

The Reserve Bank of India is the central bank of our country and is known as the Banker's Bank. RBI was established under the Reserve Bank of India Act, 1934. The Act provides the statutory basis for the functioning of the Bank. RBI was set-up on basis of the recommendations of the Hilton Young Commission and commenced its operations on 1st April 1935 having its headquarters in Kolkata and later in 1937, it was shifted to Mumbai.

Initially, RBI was a privately held bank. It was started

with a Share Capital of Rs. 5 Crore, having its shares divided into Rs.100 each

fully paid up. After independence, the Reserve Bank (Transfer to Public

Ownership) Act 1948, was passed by the Indian Government. The Act gave authority to the Government to

take over RBI from the private shareholders. The shareholders were given

compensation for their shareholding from the Government. Thus, RBI was

nationalised on January 1st, 1949 and since then it is a government-owned bank.

The Bank was constituted to

- Regulate the issue of banknotes

- Maintaining reserves to secure monetary stability and

- To operate the credit and currency system of the country to its advantage.

After liberalisation in 1992, the Bank's focus has shifted to core central banking functions. In 2016, the Monetary Policy Committee was established. Before the establishment of the committee key decisions related to monetary policy in India was taken by the Governor of RBI.

At Present, Shri. Shaktikanta Das is the Governor of RBI and RBI has 27 regional offices, most of them are located in state capitals and 4 Sub-offices in India.

Banking Regulation Act, 1949

In the 1940s, the government wasn't able to regulate commercial banks based only on the Indian Companies Act, 1913. The Banking Regulation Act 1949, was introduced in India to regulate all banking firms. Initially, the legislation was passed as "The Banking Companies Act, 1949" and later in 1966, the Title of the act was changed to "The Banking Regulation Act, 1949". The Act was commenced on 16th March 1949 and from 1956 the Act became applicable to Jammu and Kashmir. The Act is a supplement to the existing Companies Act. The legislation was amended in 1965 and it was made applicable to all Commercial and Co-Operative Banks. In 2020, the Act was amended by the bill introduced by Finance Minister Smt. Nirmala Sitharaman. The Banking Regulation (Amendment) Act, 2020 was passed to bring all Co-Operative Banks under the supervision of RBI. The act was amended to safeguard the interest of the depositors. The Amended Act allows RBI to initiate a scheme for reconstruction or merging of a bank without placing it under moratorium.

The Act provides the RBI power/right to-

- To License banks in India

- To Supervise the management of Banks

- To Regulate banking operations

- The Right to remove or appoint a Board of Director in Banks

- To have regulation over Shareholding and Voting Rights of Shareholders

- The Right to make changes in the banking policies and it is issued to all the banks.

Imperial Bank of India

|

| Image Source: https://en.wikipedia.org/wiki/ Imperial_Bank_of_India |

In 1921, the three Presidential Banks were merged into one to form a single bank, which is called the "Imperial Bank of India". The shareholders of the three Presidency Banks were the owners of the Bank and 80% of the Imperial Bank were privately owned.

The British Government's decision to form a central bank was highly influenced by the book "Indian Currency and Finance" which was authored by J.M. Keynes in 1912.

The Royal Charter to form Imperial Bank received its assent from the Governor-General of India on September 19 1920. The Imperial Bank of India commenced its operations on January 27 1921. As per its royal charter, the bank acted as a central bank. Prior, to the formation of Reserve Bank of India, The Imperial bank performed all the functions which are normally carried out by a central bank. The Bank also performed the functions of a commercial bank.

The Bank was formed with an idea of making it a Central Bank. In 1926, Hilton Young Commission recommended that the central bank must be established separately to carry out the functions of a Central Bank.

In 1935, the RBI was set-up, The Imperial Bank ceased its functions as a central bank and later it merely performed as a commercial bank and certain business restrictions on it were removed.

To expand the banking facilities on a large scale, more particularly in rural and semi-urban areas. The Rural Credit Survey Committee recommended the government to establish a wholly Government-owned commercial bank in India. Based on the recommendations received from the committee, "The Imperial Bank of India" was nationalized in 1955.

The Imperial Bank of India is one of the oldest commercial banks in India. Since 1955, it is known as - The State Bank of India and it has served the needs of Indian economic development. SBI is currently the largest Public Sector Bank in India.

State Bank of India:

By Nationalisation of Imperial Bank, the Government of India and the Reserve Bank of India jointly assumed the ownership of Imperial Bank of India and the bank was renamed as "The State Bank of India".

The State Bank of India was established under the "State Bank of India Act, 1955." The Act was passed in the Parliament on 8th May 1955, to constitute a State Bank for India. The Bank was constituted to carry on the business of banking and other business as per the provisions of the Act and to take over the business and undertaking of the Imperial Bank of India. State Bank of India commenced its operations on July 1, 1955.

As per the provisions of The State Bank of India Act 1955, Reserve Bank of India (central bank) acquired a controlling interest in the Imperial Bank of India, by taking a 60% stake.

In 2008, the Government of India acquired the entire RBI stake of 59.73% in SBI at around Rs.35, 531 Crore. The then, Finance Minister Mr P Chidambaram had provided a sum of Rs.40,000 Crore in the Budget for 2007-08 for the deal. Prior, to the deal, the State Bank of India was almost wholly owned by the RBI and RBI is the country's banking regulatory authority. Therefore, the government's move to acquire the stakes of SBI held by RBI was taken to remove the conflict of interest and thereby enabling the central bank to concentrate on its core function of Banking Regulator.

The Government of India is the largest shareholder of SBI, a Fortune 500 company. In Sept. 2020, the government holds 57.63% of shares in SBI.

SBI is governed by the Board of Directors headed by a Chairman. The Chairman and Managing Directors of the bank are appointed by the Government.

The logo of the State Bank Group has a keyhole which symbolises financial security but it also looks like Kankaria Lake in Ahmedabad.

|

| Image Source: www.google.co.in |

SBI is the largest and oldest commercial bank in India. SBI is one of the Big Four banks of India, along with ICICI Bank, Bank of Baroda and Punjab National Bank. SBI is categorized as an Indian Multinational, Public sector banking and financial services company, having its headquarters located in Mumbai, Maharashtra.

SBI is ranked among the top 50 Global Banks. SBI is the 43rd largest bank in the world. In 2020, SBI is the only Indian bank to be featured for the 14th time on the Global Fortune 500 list of the world's biggest corporations. SBI ranked 236th in 2019 and in 2020 it has risen 15 ranks to 221st position in the Global Fortune 500 list. As of 2020, SBI ranks 4th in Fortune India 500 list of India's largest corporations.

Since its inception, SBI has been constantly focusing on the development of the Indian Banking Sector. SBI is providing its services with utmost customer satisfaction. As per SBI's Annual Report for the FY 19-20, SBI has total branches of 22,141 and 58,555 ATMs in India and 233 foreign offices spread across 36 countries.

Subsidiaries of SBI

Four years after SBI was constituted, the Government passed "The State Bank of India (Subsidiary Banks) Act, 1959" on 10th September 1959. The Act provides provision for formation, management and control of subsidiary banks. The subsidiaries were the eight banks which were earlier operated by individual princely states. The Government of India integrated these banks into the State Bank of India system to expand its rural outreach. Among these 8 banks, State Bank of Hyderabad became the first subsidiary of SBI. Subsidiary banks are almost owned by SBI. The Subsidiary Banks of SBI which were constituted under this Act are:

In June 2016, the Cabinet approved the merger of State Bank of India (SBI) and five of its Associate Banks to make SBI one among the top 50 global-sized banks. The five associated banks of SBI and Bharatiya Mahila Bank were merged with SBI on 1st April 2017. This was the first-ever large scale consolidation in the Indian Banking Industry.

As per RBI's Press Release issued on March 2017, it states that with effect from April 1 2017, all branches of the associate banks will function as branches of SBI and all Customers of the associate banks will be treated as customers of SBI.

Hence, from 1 April 2017 SBI commenced its operations as a unified entity and SBI sported its new logo.

Before the merger, in 2015 SBI was ranked 52 in the world and after the merger, India's largest bank SBI has entered the league of top 50 Global Banks. As of 2020, SBI ranks 43rd in the Global Banks.

Nationalisation of Banks:

Nationalisation refers to the action of taking over a

private organisation, by the Government. By Nationalisation, the ownership and

control of private organisations end up with the Government bodies. In India,

Nationalisation of Banks was the biggest structural reforms introduced in the

financial sector. Reserve Bank of India was the first bank to be nationalized

in 1949. Imperial Bank of India was nationalised in 1955 and renamed as SBI. In

1969, the government nationalised 14 largest commercial banks and further, 6

other banks were nationalised in 1980.

Before Nationalisation in 1969, except State Bank of India,

major commercial banks were owned and operated by Private Organisations. These

Private Banks were often accused of mismanagement of funds. The public largely

lost confidence in banks. The services of the banks were catered in favour of

large industries and business houses and they ignored the priority sector

mainly agriculture and small-scale industries. These Private Banks didn't focus

on the penetration of banks mainly in rural and backward areas.

|

| Image Source: The Times of India |

To solve various issues, the Government under the then, Prime Minister Smt. Indira Gandhi decided to nationalise banks through an Ordinance. The Government of India issued The Banking Companies (Acquisition and Transfer of Undertakings) Ordinance, 1969. On 19 July 1969, 14 largest commercial banks were nationalised under the ordinance and these banks held 70-85% of bank deposits in the country. The Banking Companies (Acquisition and Transfer of Undertaking) Bill was passed in the Parliament and The Banking Companies (Acquisition and Transfer of Undertakings) Act, 1969 received Presidential assent on August 9, 1969.

In 1980, six more private banks were nationalised by the

Government. These banks were nationalised under The Banking Companies

(Acquisition & Transfer of Undertakings) Act, 1980.

In India, the banks were nationalised under the above

mentioned two Acts. The State Bank of India and nationalised banks are governed

by different Statutes. No banks in India were nationalised after

Liberalisation.

After Nationalisation, banks followed a uniform banking policy. The efficiency of the banking system got increased, which resulted in profitability. The bank's profits were used by the government for the betterment of people. Banks focused on penetration of banks and new branches were opened in unbanked areas. Helped the priority sectors that were lagging. Banks gained the confidence of the public and there was an increase in public deposits which led to an increase in funds. Thus, Nationalisation gave an increase in the economic growth of India.

In August 2019, Finance Minister of India, Shri. Nirmala Sitharaman announced the massive amalgamation. With effect from 1 April 2020, 10 Public Sector Banks was merged into 4. After this biggest consolidation, the total number of Public Sector Banks has come down from 27 banks in 2017 to 12 in 2020.

At Present, there are 12 Public Sector Banks in India including the State Bank of India.

Liberalisation Period (1991-Till Date):

Liberalization refers to the changes made in the economic philosophy of a country. In the early 1990s, the government embarked on a policy of liberalisation in India. Liberalisation was initiated to create the economy more market and service-oriented by giving markets a major role in setting prices, allocating resources, and increasing the role of the private sector and foreign investment. Liberalization in the Indian banking sector gave licensing to a small number of private banks to establish and they were known as New Generation tech-savvy banks. The new economic policy of liberalisation stirred the entire Banking sector and this led to the retail boom in the country.

Liberalisation with the Banking sector, a committee was formed by the government to offer recommendations on banking sector reforms. The Committee was set-up under the Leadership of Mr Narasimham (13th Governor of RBI). The first Narasimham Committee was formed in the year 1991. The report given by the committee served as a blueprint for the initial banking sector reforms.

From the report given by the Committee, only a few of its recommendations were considered and because of this, the government had to set-up another committee in 1998. This Second Committee was also formed under the Chairmanship of Mr Narsimham and the second Committee is better known as the Banking Sector Committee.

The Committee was asked to review the progress of banking reforms and to design a programme for strengthening the country's banking system. The committee focused on major areas such as Capital Adequacy, Non-Performing Assets (NPA), Prudential Norms, Bank Mergers, Bank Legislation, Rural & Small Industrial credits, etc.

The Government

introduced various reforms in the banking sector from the recommendations given

by both the committees. The reforms taken based on the recommendations includes

- Liberalization of Interest rates,

- Reduction of Reserved Ratios,

- Liberalisation in entry to the banking sector for both Domestic and Foreign Banks

The other measures taken include:

- Setting up of branches by Foreign Banks in India

- No more nationalisation of Banks could be done

- The committee announced that RBI and Government would treat both public and private sector banks equally

- Foreign Banks were allowed to start joint ventures with Indian Banks

- Small Finance Banks were allowed to set their branches across India

- The process of introducing Information Technology in all branches of banks began in 1993

- A major part of Indian banking moved online with internet banking and apps available for fund transfer

- Payments banks were introduced with the development in the field of banking and technology

- FII (Foreign Institutional Investors) were allowed to invest in dated Government Securities.

Thus Liberalisation proved to be a great boon to the banking system. The structural changes which were implemented on the recommendations of various committees have transformed and strengthened the Indian Banking System.

I found this article is interesting and useful.

ReplyDeleteGreat job juda 👍

ReplyDelete